Between Phantom Deals and Empty Promises, Syria is Collapsing Internally

Despite repeated official statements about new investors entering the market and signing major commercial deals, the Syrian economy remains largely fragile. The reality on the ground tells a different story from the official announcements. Many of these investments pass through unknown or fictitious companies, while Syrians struggle daily under the weight of crushing inflation, collapsing purchasing power, and a government relying on external support to meet its simplest obligations.

Independent press reports have revealed that some of the promoted deals are nothing more than media façades. The so-called “UBAKO” company, which announced an investment worth billions of dollars, turned out to be a small, newly registered Italian company with no prior experience. Meanwhile, the Turkish company “Polidef,” which announced plans to develop Damascus International Airport with $4 billion, was found to have a false Istanbul address and a website lacking any real information.

These examples deepen suspicions and confirm earlier accounts that the announced investments have no tangible impact on the economy, but rather conceal private interests or opaque financial operations.

In several cities like Homs, Hama, and Deir Ezzor, the government of Ahmed Al-Shar’a launched popular donation campaigns under slogans supporting reconstruction, helping needy families, health, and others. However, local sources confirmed that these campaigns are merely recycling funds internally, aiming to divert public attention from the harsh economic deterioration, as prices remained the same and citizens’ suffering worsened.

Meanwhile, media reports stated that the donation campaigns essentially recycle funds: some are actually used in certain projects and promoted through the media, while the remaining amounts are transferred to foreign bank accounts belonging to suspicious individuals with no future and a history rife with terrorism.

The crisis peaked when the government was forced to rely on external aid to pay its employees’ salaries. In May 2025, the government announced that Qatar would pay approximately $29 million monthly for three months to cover public sector salaries in health, education, and social affairs, alongside non-military pensions. Despite the importance of this aid, it only covers about 20% of the promised salary increase, according to international reports, reflecting the fragility of Syrian public finances and their dependence on foreign sources.

Despite promoting restructuring plans, the Syrian pound remained stagnant without notable improvement. In August 2025, plans leaked for issuing a new currency that would remove two zeros from the current one, with both old and new denominations circulating until the end of 2026.

However, economists, including Karam Shaar, confirmed that this step would not change the real value of the currency and is merely a cosmetic fix to a structural problem. Inflation, the absence of financial reforms, and deep-rooted corruption remain far greater factors than any digital makeover.

Confirming the above, Central Bank Governor Abdel Qader Al-Hasriya stated that the zero removal would not change the real value of the currency, meaning the purchasing power of citizens will not automatically improve just by deleting zeros.

As a result, removing zeros and issuing a new currency may ease the burden of cash transactions but does not address the root causes such as inflation, weak local production, interrupted imports, chaotic government spending, and corruption.

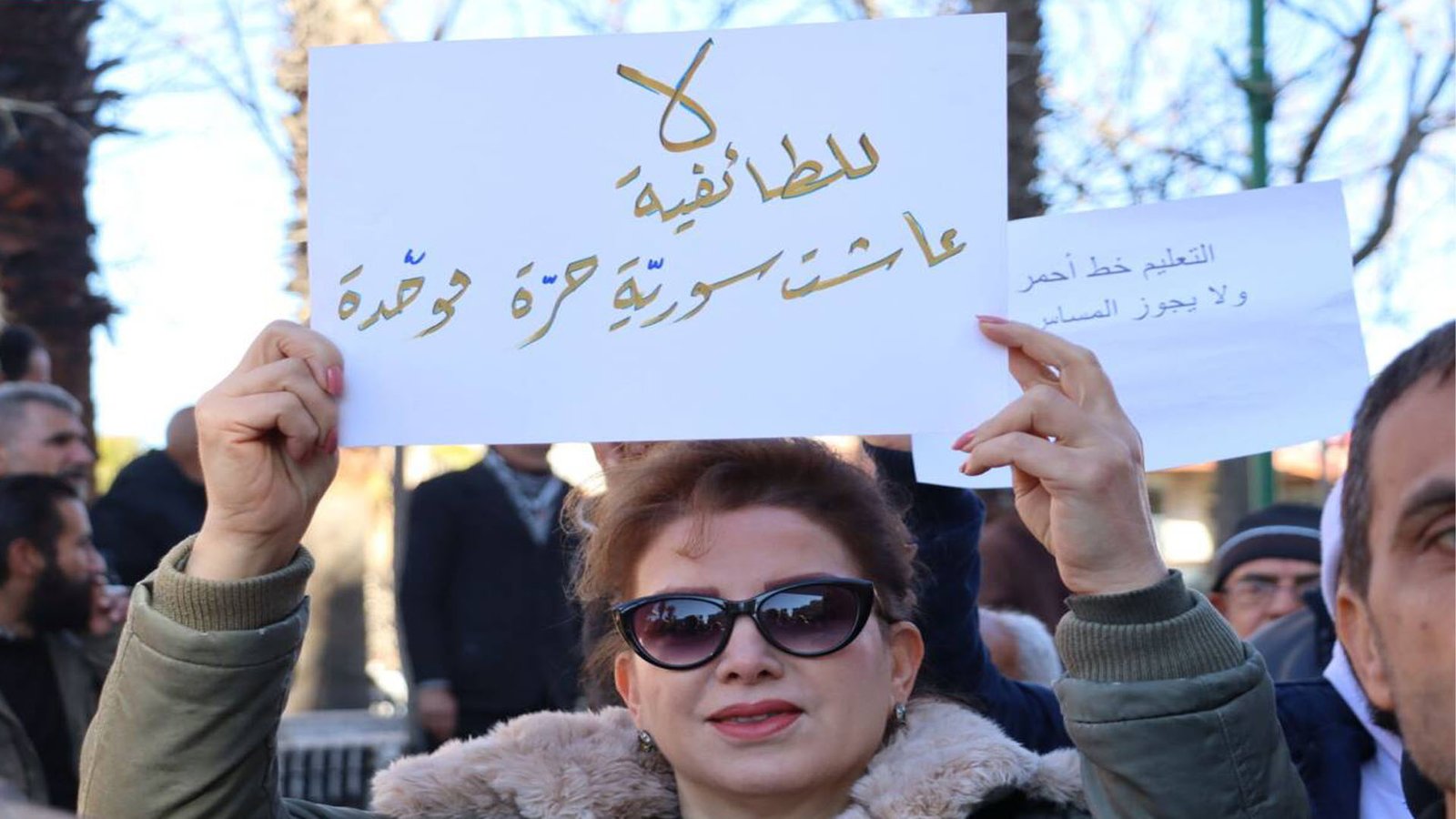

Between ethnic and sectarian conflicts exploited against minorities, regional interventions, phantom deals, superficial donation campaigns, and reliance on external sources to secure salaries, the picture remains clear: the Syrian economy is extremely fragile and far from recovery. As for promises of a new currency or major deals, these are merely cosmetic attempts to mask a dire living reality. For Syrians, the only constant truth is daily inflation, the collapse of purchasing power, and diminishing hope for real economic reform in the foreseeable future.